Catalyze your growth with our

innovative features

FEATURES

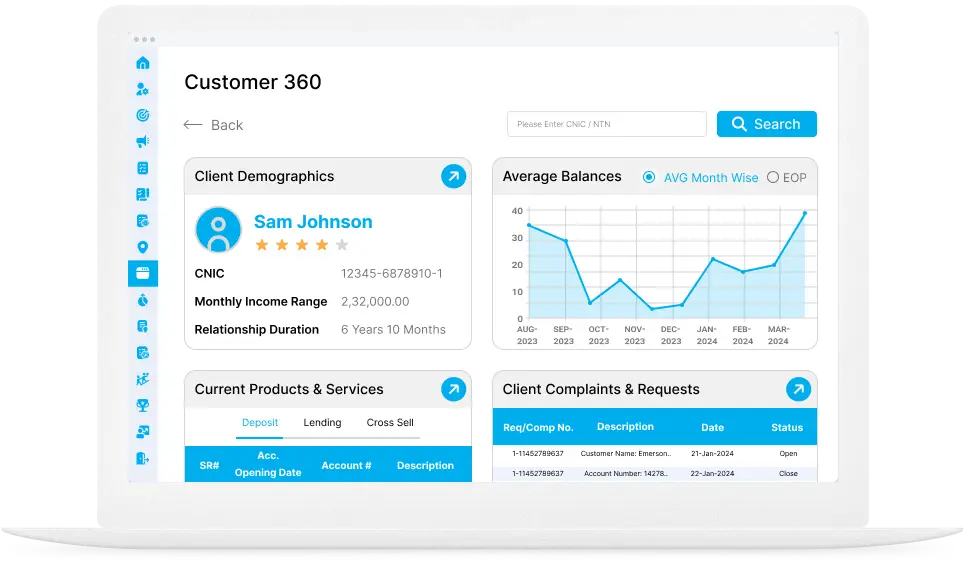

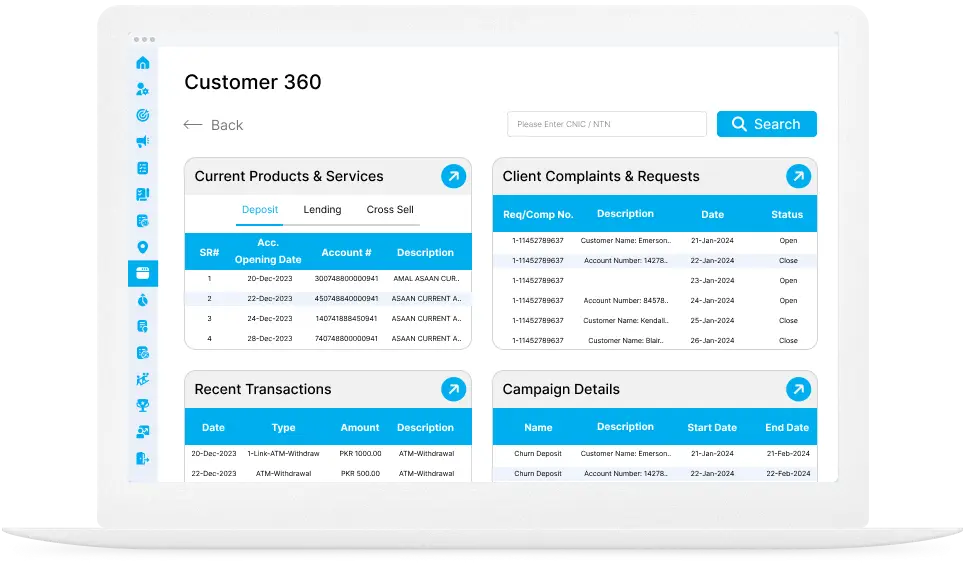

Customer 360

Get a 360-degree view of each individual customer or account with our Customer 360 feature. It gathers data from multiple sources, compiles

it in one place, and presents it in an easy-to-consume manner, providing every user of the product with an in-depth view of a customer’s account history and preferences.

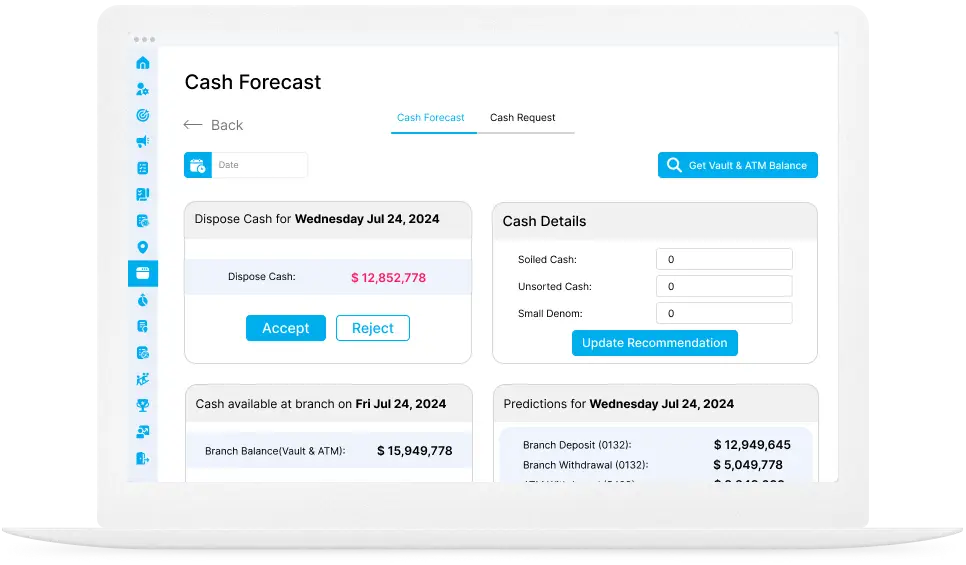

Cash Optimization

Our Cash Optimization feature uses AI models and your cash history logs to create accurate predictions for cash demand by branch, helping the bank optimize cash usage and address any shortages or surpluses.

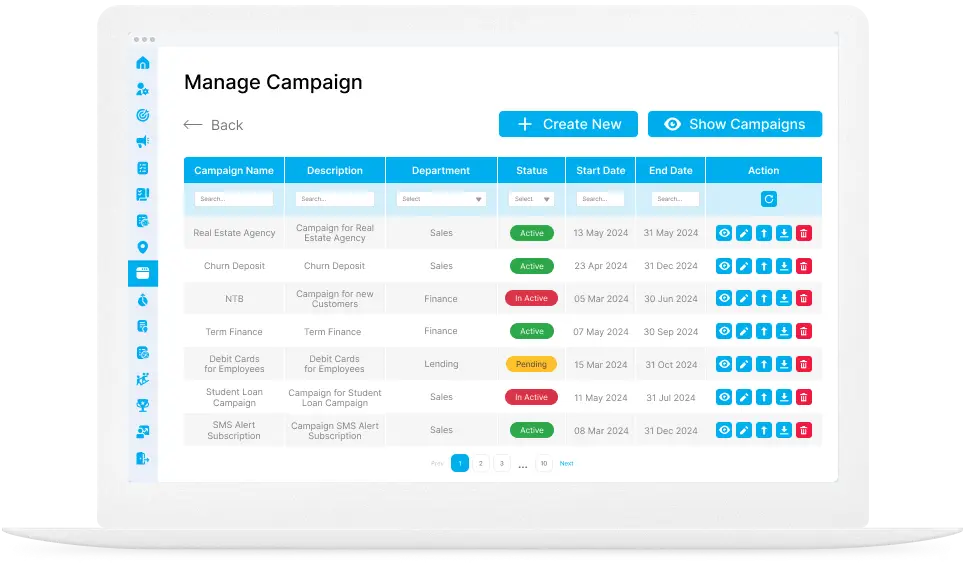

Campaigns

From retention to selling a new credit card, all initiatives require

a campaign management dashboard to run from. Our Campaigns module allows you to add the list of recipients, outline the purpose of the campaign, and assign it to relevant resources within your team.

Cross-sell & Next Best Offer

Interception at the right time is important, but it is also vital to sell the right thing to the right customer. Our AI tools work hard to suggest the next best offer for each customer, increasing the chances of successfully cross-selling a desired product.

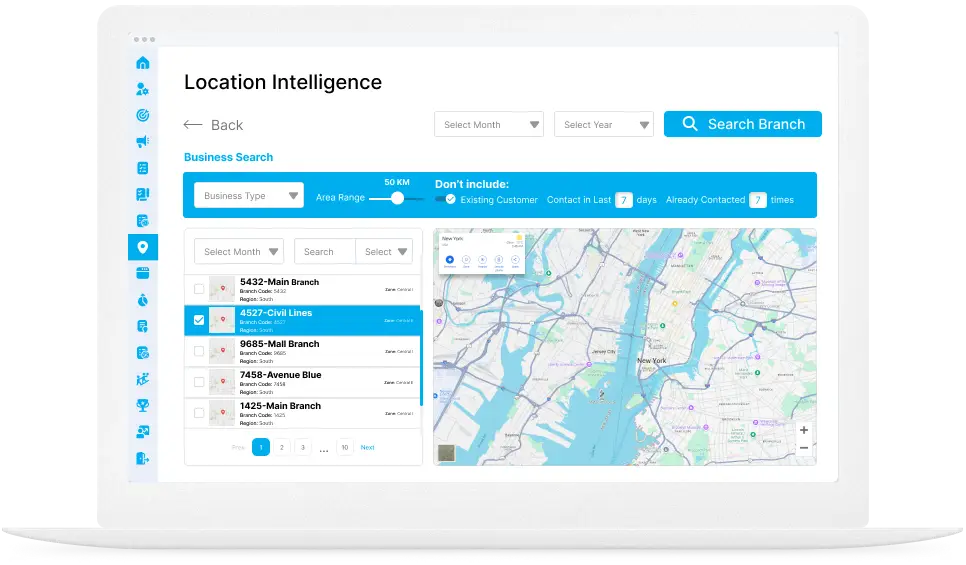

Location Intelligence

Use our cutting-edge Location Intelligence module to detect untapped businesses near your bank’s branch. Create campaigns and leads to attract new clients in the most effective way.

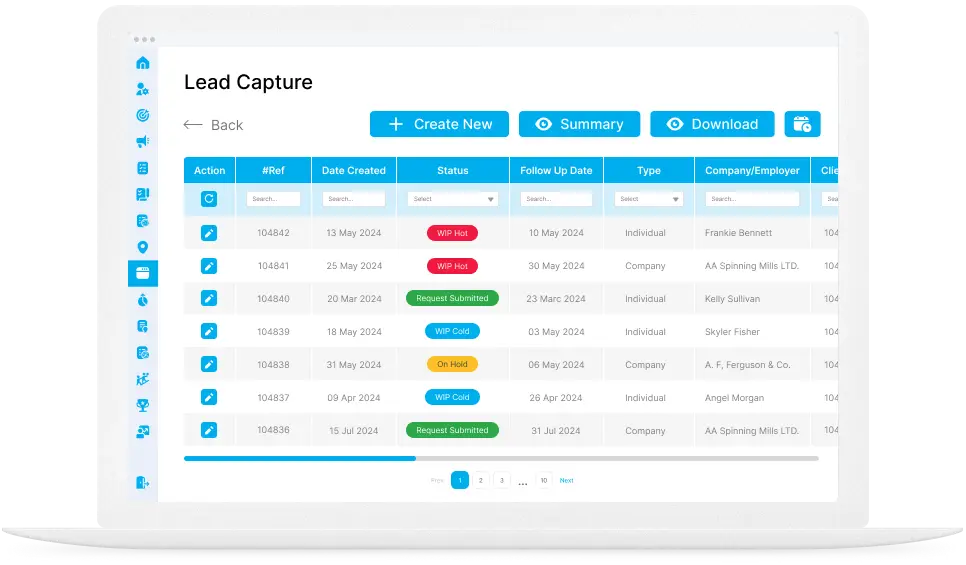

Lead Capture

Whether you want to generate new leads or create a lead from an existing customer, our Lead Capture module has you covered. Coupled with Customer 360 and Customer Profiling, it provides an expansive view

of your customers and helps you decide which lead angle to pursue.

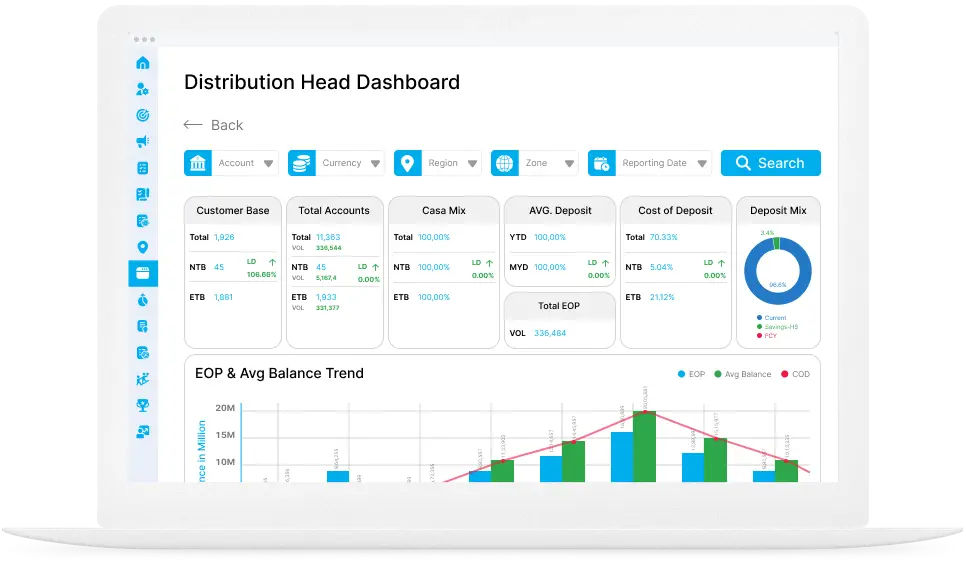

Data analytics

Understanding and optimizing sales cycles is crucial for revenue growth. Connect360, powered by analytics, enables effective analysis and

data-driven decision-making. The data can be viewed through detailed product reports and dashboards.

Use Cases

Customer

Personalization

Connect360 empowers banks to deliver tailored experiences by leveraging customer profiling, multi-platform data synchronization,

and a Customer 360 dashboard.

Manage Cash Flow and

Prevent Cash Loss

Efficient cash management is crucial in the banking industry to maximize operational efficiency and ensure customer satisfaction. Connect360, equipped with AI predictive models, enhances cash management by providing valuable insights and forecasts.

Predict Customer

Lifetime Value

Connect360 offers features such as activity trackers and lead management dashboards to optimize prospecting efforts. It also facilitates collaboration among sales teams.

Track And Prevent

Attrition

For all financial institutions, tracking churn and managing customer retention are crucial for growth and profitability. Connect360 equips banks with powerful features

to address these needs.

Prioritize High Value

Customers

For banks, prioritizing leads and optimizing conversion rates are crucial for revenue growth.

A tailored Connect360 solution can streamline lead management and enhance

conversion opportunities.

Run Auto-Triggered Campaigns

To Reduce Dormancy

Efficiently onboarding new clients is crucial

in the competitive banking industry. Connect360 revolutionizes client

onboarding by leveraging advanced lead capture techniques.

About Connect360

Connect360 is a platform that aims to transform how banks leverage their data, improve operational efficiencies, implement customer-centric strategies, and ultimately achieve sustainable growth in todays’ fast paced banking industry.

Contact Information

- Stamford, Soundview Plaza, Suite 700R, 1266 E Main St. Stamford Connecticut 06902

- +1 416 8068501

- info@connect360.tenx.ai

Copyright © 2025 Connect360

Support

Terms

Privacy Policy